Real Estate Price Trend Predictions for the Rest of 2020

Real Estate Price Trend Predictions for the Rest of 2020

We are now in the second half of this year, and the world has already changed dramatically due to the coronavirus pandemic or what we call COVID-19. This is a crisis like no other and it’s bringing substantial uncertainty about its impact on people’s lives, livelihood, and the property market for that matter.

While it’s true that the Government and Reserve Bank have quickly taken actions with stimulus, and reducing interest rates, the question about how COVID-19 really affects the property market still remains unknown. So let’s take a closer look at the Brisbane property market.

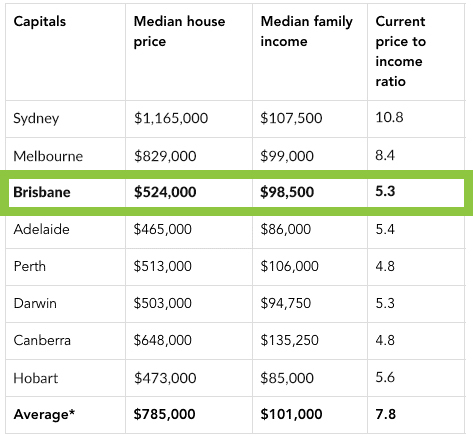

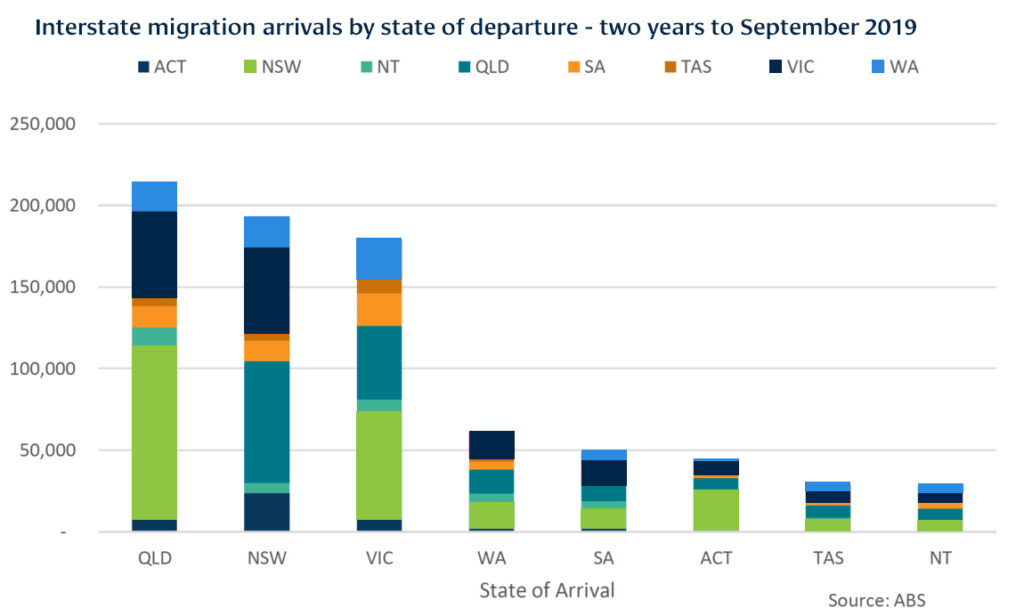

According to Property Update, Regional Queensland is likely to continue to suffer, whereas the Brisbane property market is likely to perform well, with areas like the Gold Coast and Sunshine Coast following not too far behind.Last year, the property market of Brisbane, as per CoreLogic’s report, has been slow and steady: with dwelling prices rising 1.1% for the 3 months to December or 0.4% per month. Given this, plus the Queens Wharf and Howard Smith Wharves projects, it was no wonder that Brisbane’s property market was able to set a strong start in 2020. Aside from this, the River City has also a very strong housing affordability compared to Melbourne and Sydney.

This year, furthermore, CoreLogic has shown reports that Brisbane’s dwellings values were at a new peak in March 2020 in terms of Property Market Prices, and even continued to edge higher in April, up 0.3% over the month. This is through the help of freestanding Brisbane houses within 5-7 km of the CBD or in good school catchment zones that have grown in value strongly.

Now with regards to Brisbane capital growth, the breakdown of interstate arrivals from different states to QLD is present in the graph below:

While Brisbane property prices are considerably more affordable than the other 2 east coast capital cities, earlier this year CoreLogic forecasts that one in 10 houses sold in Brisbane will fetch more than $1 million within 2 years (Property Update, 2020).

Tim Lawless of CoreLogic said that although new listings numbers were trending higher, the total listing count, which included new listings as well as re-listed properties, continued to trend down, implying a healthy rate of absorption as buyers became significantly more active once COVID-19 restrictions began to ease.

Currently we are seeing an extreme under supply of properties, with buyer demand far exceeding available listings on the market. This leads us to a confident prediction of moderate local price growth in the next 4 to 6 months, we expect once the September Quarter price indicators are known these results to be evident. The June Quarter local sale numbers were some of the lowest we have seen for many years, and this is almost entirely due to the under supply of listings.

What the trend is for the long term remains harder to predict. What we can surely say, though, is that the Brisbane property market is likely to stay strong and record positive growth for the rest of 2020 and even for the start of the following year because of the many underlying strong market factors. As we are all aware, Brisbane is one of the world’s great cities, and livability, affordability, scale and future economic prospects all suggest that Brisbane is a market where you can confidently buy.

Recent Posts

What to Consider when Applying for a Home Loan

21 Apr 2024